Have PAN Card, Aadhaar? You will have to pay Rs 1000 fine for not doing this before April 1

Fine for not linking PAN Card-Aadhaar Card: Not linking PAN and Aadhaar by March 31, 2022 may cost you Rs 1000 as penalty, according to the Income Tax rules.

Fine for not linking PAN Card-Aadhaar Card: Not linking PAN and Aadhaar by March 31, 2022 may cost you Rs 1000 as penalty, according to the Income Tax rules.

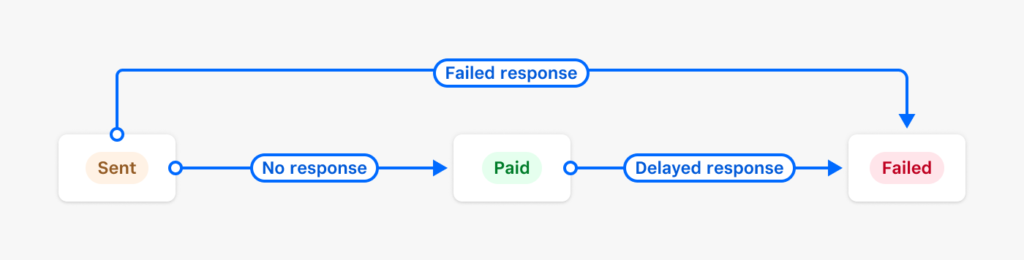

According to Section 234H of the Income Tax Act, 1961, a penalty of Rs 1000 needs to be paid as late fee if a person fails to intimate his/her Aadhaar to the Income Tax Department. The last date for linking PAN and Aadhaar is March 31, 2022

Section 234H was introduced by Finance Act 2021 and made effective from April 1, 2021. Section 139AA of Income Tax Act makes it mandatory for individuals to link their PAN and Aadhaar numbers.

Meanwhile, responding to a query today on whether the Government proposes any penalty for not linking PAN Card with Aadhaar, Minister of State for Finance Pankaj Chaudhary said in a written reply: “Finance Act, 2021 inserted a new section 234H in the Income-tax Act, 1961 to complete the process of PAN-Aadhar linking. This section provides that where a person who is required to intimate his Aadhaar under subsection (2) of section 139AA and fails to do so on or before a prescribed date, he shall be liable to pay a fee not exceeding a sum of one thousand rupees as may be prescribed, at the time of making intimation under sub-section (2) of section 139AA after the said date.”

“31st March, 2022 is the last date for intimating Aadhaar as notified vide notification dated 17.09.2021,” he added.

The Government has extended the last date of linking PAN Card and Aadhaar a number of times in past. However, the due date may not be extended.

If PAN is not linked with Aadhaar by March 31 then if will become inoperative. PAN is required for filing Income Tax Returns and for various other purposes.

PAN-Aadhaar linking can be done easily online (read how to link PAN and Aadhaar here).