- Multi Role Login System Using PHP

Welcome to the Multi-Role Login System, a sophisticated web application crafted to deliver secure and role-specific access using PHP and MySQL. This dynamic system introduces an innovative approach to user authentication, allowing individuals to log in with distinct roles, such as “Admin” or “User,” each with unique privileges. Through a seamless integration of PHP for server-side scripting and MySQL for robust data management, the Multi-Role Login System offers a secure and efficient solution for handling user authentication and access control. The project stands out with its responsive and visually appealing interface, designed using HTML5, CSS3, and Bootstrap 4, ensuring a consistent and user-friendly experience… Read more: Multi Role Login System Using PHP

Welcome to the Multi-Role Login System, a sophisticated web application crafted to deliver secure and role-specific access using PHP and MySQL. This dynamic system introduces an innovative approach to user authentication, allowing individuals to log in with distinct roles, such as “Admin” or “User,” each with unique privileges. Through a seamless integration of PHP for server-side scripting and MySQL for robust data management, the Multi-Role Login System offers a secure and efficient solution for handling user authentication and access control. The project stands out with its responsive and visually appealing interface, designed using HTML5, CSS3, and Bootstrap 4, ensuring a consistent and user-friendly experience… Read more: Multi Role Login System Using PHP - Insurance Management System PHP and MySQL

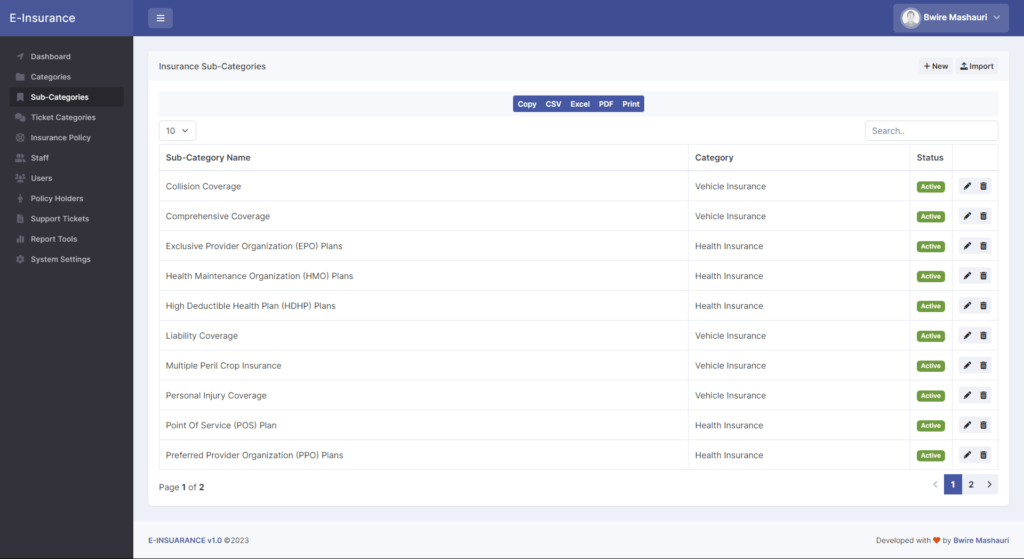

This PHP and MySQL Project is entitled Insurance Management System. This is a web application that is specifically built for Insurance Companies. Insurance Management System Project In PHP is a project that insurance companies use to run their businesses much more efficiently. It consists of multiple features and functionalities that are relatively aligned with some instructions and processes of said company. The application has a pleasant user interface and user-friendly features and functionalities. Modules This Insurance Management System consists of the following modules: Features and Functionalities Admin Module: Staff Module: User Module: You may also check some simple PHP and MySQL projects: How to… Read more: Insurance Management System PHP and MySQL

This PHP and MySQL Project is entitled Insurance Management System. This is a web application that is specifically built for Insurance Companies. Insurance Management System Project In PHP is a project that insurance companies use to run their businesses much more efficiently. It consists of multiple features and functionalities that are relatively aligned with some instructions and processes of said company. The application has a pleasant user interface and user-friendly features and functionalities. Modules This Insurance Management System consists of the following modules: Features and Functionalities Admin Module: Staff Module: User Module: You may also check some simple PHP and MySQL projects: How to… Read more: Insurance Management System PHP and MySQL - Email Sender Using PHP and PHPMailer with Source Code

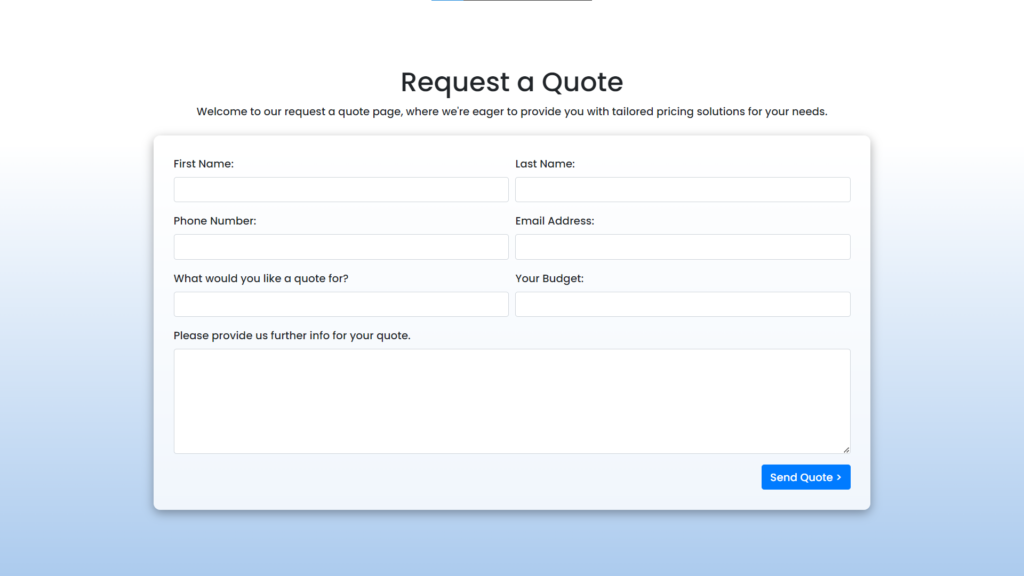

Request A Quote Page with Email Sender Using PHP and PHPMailer with Source Code Welcome to our Request a Quote page, a streamlined solution designed to facilitate seamless communication between you and our team. In today’s dynamic business landscape, obtaining accurate and tailored pricing solutions is paramount, and our platform aims to simplify this process. With a user-friendly interface and robust features, our Request a Quote page enables you to effortlessly submit your requirements and receive prompt responses tailored to your needs. Our platform leverages cutting-edge technologies, including HTML, CSS (Bootstrap), PHP, and PHPMailer, to ensure a smooth and secure experience. The incorporation of… Read more: Email Sender Using PHP and PHPMailer with Source Code

Request A Quote Page with Email Sender Using PHP and PHPMailer with Source Code Welcome to our Request a Quote page, a streamlined solution designed to facilitate seamless communication between you and our team. In today’s dynamic business landscape, obtaining accurate and tailored pricing solutions is paramount, and our platform aims to simplify this process. With a user-friendly interface and robust features, our Request a Quote page enables you to effortlessly submit your requirements and receive prompt responses tailored to your needs. Our platform leverages cutting-edge technologies, including HTML, CSS (Bootstrap), PHP, and PHPMailer, to ensure a smooth and secure experience. The incorporation of… Read more: Email Sender Using PHP and PHPMailer with Source Code - Image Compressor Tool Using PHP with Source Code

Welcome to the Image Compressor Tool, a web-based application designed to streamline the process of image compression. This tool allows users to effortlessly upload their images, preview both the original and compressed versions, and download the optimized images directly. The main aim is to significantly reduce image file sizes while preserving acceptable quality, making it easier to manage images for web usage, email attachments, and storage optimization. This user-friendly application is built using PHP, HTML5, CSS3, and JavaScript, with the GD library handling the image processing. The intuitive interface ensures a seamless experience, allowing users to quickly compress images with just… Read more: Image Compressor Tool Using PHP with Source Code

Welcome to the Image Compressor Tool, a web-based application designed to streamline the process of image compression. This tool allows users to effortlessly upload their images, preview both the original and compressed versions, and download the optimized images directly. The main aim is to significantly reduce image file sizes while preserving acceptable quality, making it easier to manage images for web usage, email attachments, and storage optimization. This user-friendly application is built using PHP, HTML5, CSS3, and JavaScript, with the GD library handling the image processing. The intuitive interface ensures a seamless experience, allowing users to quickly compress images with just… Read more: Image Compressor Tool Using PHP with Source Code - Registration form with admin Source Code

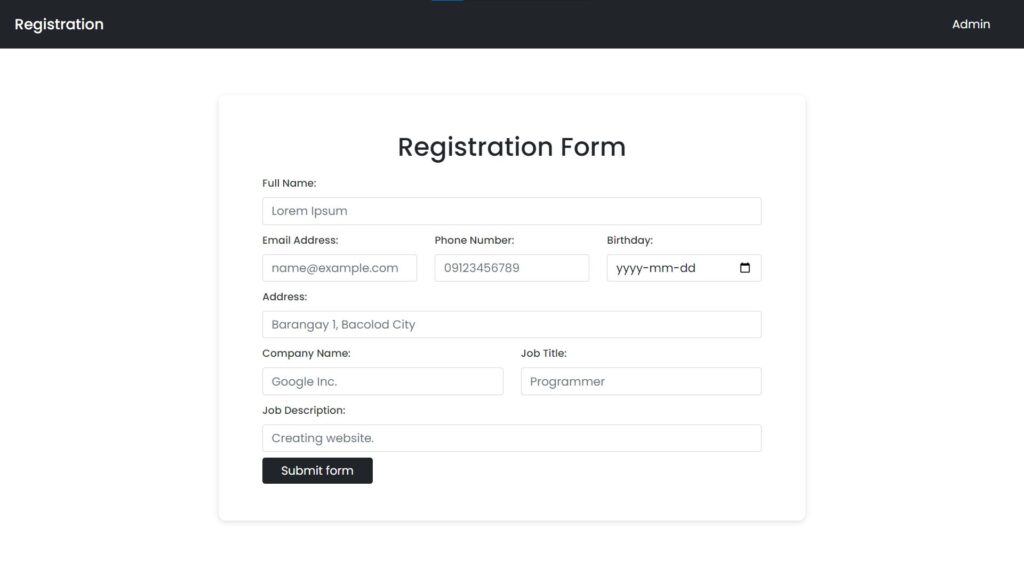

Profile Registration without Reload/Refresh Using AJAX, PHP and MySQL with Source Code Welcome to the Profile Registration with Reload/Refresh Using Ajax, PHP, and MySQL project! This innovative application simplifies the process of user registration while ensuring seamless data management for administrators. By leveraging Ajax for real-time form submissions, users can quickly register their profiles without the need for page reloads. This enhances the user experience, making the registration process smooth and efficient. The application captures essential information, including personal details and job-related data, and securely stores it in a MySQL database. On the admin side, this project features a robust dashboard where… Read more: Registration form with admin Source Code

Profile Registration without Reload/Refresh Using AJAX, PHP and MySQL with Source Code Welcome to the Profile Registration with Reload/Refresh Using Ajax, PHP, and MySQL project! This innovative application simplifies the process of user registration while ensuring seamless data management for administrators. By leveraging Ajax for real-time form submissions, users can quickly register their profiles without the need for page reloads. This enhances the user experience, making the registration process smooth and efficient. The application captures essential information, including personal details and job-related data, and securely stores it in a MySQL database. On the admin side, this project features a robust dashboard where… Read more: Registration form with admin Source Code - Image Upload PHP Software

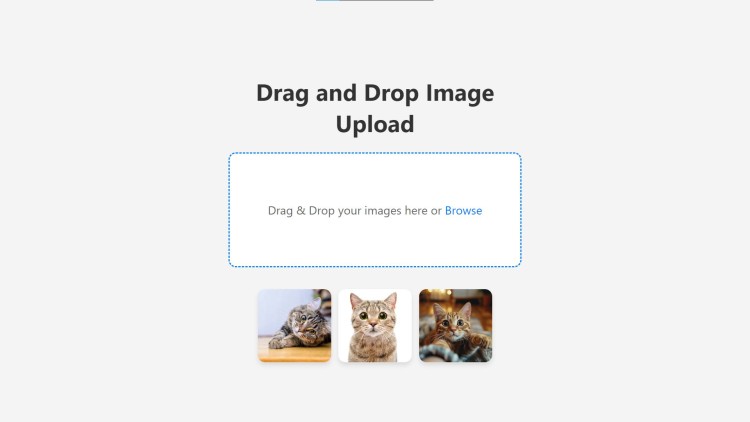

Drag and Drop Image Upload without Refresh/Reload Using PHP and Ajax with Source Code Welcome to the Drag and Drop Image Upload without Reload Using PHP and Ajax project! This innovative web application provides users with a seamless and intuitive way to upload images directly from their devices. With its drag-and-drop interface, users can easily drag images into a designated area or click to browse for files. The built-in preview feature allows users to verify their selections before uploading, ensuring a smooth and error-free process. This application is designed for efficiency and simplicity, making image uploads faster and more user-friendly.… Read more: Image Upload PHP Software

Drag and Drop Image Upload without Refresh/Reload Using PHP and Ajax with Source Code Welcome to the Drag and Drop Image Upload without Reload Using PHP and Ajax project! This innovative web application provides users with a seamless and intuitive way to upload images directly from their devices. With its drag-and-drop interface, users can easily drag images into a designated area or click to browse for files. The built-in preview feature allows users to verify their selections before uploading, ensuring a smooth and error-free process. This application is designed for efficiency and simplicity, making image uploads faster and more user-friendly.… Read more: Image Upload PHP Software - Recharge API Operator Codes

Mobile Operators Operator Code Airtel AT BSNL BT BSNL SPECIAL BSP Jio JIO Vi VI DTH Operators Operator Code Airtel DTH ATDTH Dish TV DISHTV Sun Direct SUNDTH Tata Sky TATASKY Videocon D2H VDDTH Postpaid Operators Operator Code Airtel Postpaid PA BSNL Postpaid PB JIO Postpaid PJIO VI Postpaid PV GiftCard Operators Operator Code Fields Google Play Code GPLAY field1 : Mobile No Electricity Operators Operator Code Fields Adani Electricity Mumbai Limited EADANI field1 : Consumer Number Ajmer Vidyut Vitran Nigam Ltd EAVVNL field1 : K Number APEPDCL – Eastern Power Distribution CO AP Ltd. APEPDCL field1 : Service Number APSPDCL – Southern Power… Read more: Recharge API Operator Codes

Mobile Operators Operator Code Airtel AT BSNL BT BSNL SPECIAL BSP Jio JIO Vi VI DTH Operators Operator Code Airtel DTH ATDTH Dish TV DISHTV Sun Direct SUNDTH Tata Sky TATASKY Videocon D2H VDDTH Postpaid Operators Operator Code Airtel Postpaid PA BSNL Postpaid PB JIO Postpaid PJIO VI Postpaid PV GiftCard Operators Operator Code Fields Google Play Code GPLAY field1 : Mobile No Electricity Operators Operator Code Fields Adani Electricity Mumbai Limited EADANI field1 : Consumer Number Ajmer Vidyut Vitran Nigam Ltd EAVVNL field1 : K Number APEPDCL – Eastern Power Distribution CO AP Ltd. APEPDCL field1 : Service Number APSPDCL – Southern Power… Read more: Recharge API Operator Codes - PHP send an email with an attachment

Sending emails with attachments is a common task while developing PHP applications, achieved using PHP’s built-in mail() function. The mail() function allows developers to send emails with text or HTML content and attach one or more files. Here’s a sample PHP code that demonstrates how to send an email with an attachment in PHP: Example: The recipient’s email address, subject, message body, and header information are defined in the code above. The boundary variable separates the message and attachment in the email. The attachment is read from a file using file_get_contents() and encoded using base64_encode(). The chunk_split() function splits the attachment into smaller chunks for sending. Finally, the mail() function sends… Read more: PHP send an email with an attachment

Sending emails with attachments is a common task while developing PHP applications, achieved using PHP’s built-in mail() function. The mail() function allows developers to send emails with text or HTML content and attach one or more files. Here’s a sample PHP code that demonstrates how to send an email with an attachment in PHP: Example: The recipient’s email address, subject, message body, and header information are defined in the code above. The boundary variable separates the message and attachment in the email. The attachment is read from a file using file_get_contents() and encoded using base64_encode(). The chunk_split() function splits the attachment into smaller chunks for sending. Finally, the mail() function sends… Read more: PHP send an email with an attachment - Sample Calculator Program

An HTML form is shown in the following example code to display the calculator program: Output: Download Code Once the form is submitted, the PHP $_POST super global variable receives all input values. After that, it validates the input and displays it if an error occurs. Then, comparison and arithmetic operators within the conditional statements are used to calculate the expected value. PHP Code:

An HTML form is shown in the following example code to display the calculator program: Output: Download Code Once the form is submitted, the PHP $_POST super global variable receives all input values. After that, it validates the input and displays it if an error occurs. Then, comparison and arithmetic operators within the conditional statements are used to calculate the expected value. PHP Code: - PHP Age Calculator Program codePHP Age calculator program demo code Output: Code Download

- Marquee Tag

Here’s are some example of how to use <marquee> tag in HTML: Scroll Up Example: Output: This is a sample scrolling text that has scrolls in the upper direction. Scroll Down Example: Output: This is a sample scrolling text that has scrolls texts to down. Scroll Left to Right Example: Output: This is a sample scrolling text that has scrolls texts to right. Scroll Right to Left Example: Output: This is a sample scrolling text that has scrolls texts to left. Scrolling Speed Marquee speed can be changed using the “scrollmount” attribute. For example, if you are using scrollmount=”1″ then it sets the marque… Read more: Marquee Tag

Here’s are some example of how to use <marquee> tag in HTML: Scroll Up Example: Output: This is a sample scrolling text that has scrolls in the upper direction. Scroll Down Example: Output: This is a sample scrolling text that has scrolls texts to down. Scroll Left to Right Example: Output: This is a sample scrolling text that has scrolls texts to right. Scroll Right to Left Example: Output: This is a sample scrolling text that has scrolls texts to left. Scrolling Speed Marquee speed can be changed using the “scrollmount” attribute. For example, if you are using scrollmount=”1″ then it sets the marque… Read more: Marquee Tag - UPI Payment Button Generator

DEMO SAMPLE Pay using UPI

DEMO SAMPLE Pay using UPI - how to apply pan cardApplying for a PAN card is an important process that is necessary for any individual who wants to pay taxes in India. It is an identity document that serves as an authorization for all taxable income and investments. It is a PAN (Permanent Account Number) card issued by the Indian government. The process of applying for a PAN card is simple and straightforward, and it can be completed online or offline. A PAN card is an important document that is needed for filing taxes, opening a bank account, and conducting many other financial transactions. It is a unique 10-digit alphanumeric… Read more: how to apply pan card

- UTI & Recharge Whitelabel MappingA white-label PAN (Permanent Account Number) card website refers to a customizable platform for issuing and managing PAN cards. It enables companies to provide their customers with the ability to apply for and receive PAN cards, using the company’s own branding, rather than that of the government. The website’s source code, design, and branding elements can be modified to fit the company’s own style and requirements. A recharge white label refers to a customizable platform for online recharge services, allowing companies to provide their customers with the ability to recharge their mobile phones, DTH services, data cards, and other such… Read more: UTI & Recharge Whitelabel Mapping

- What is API

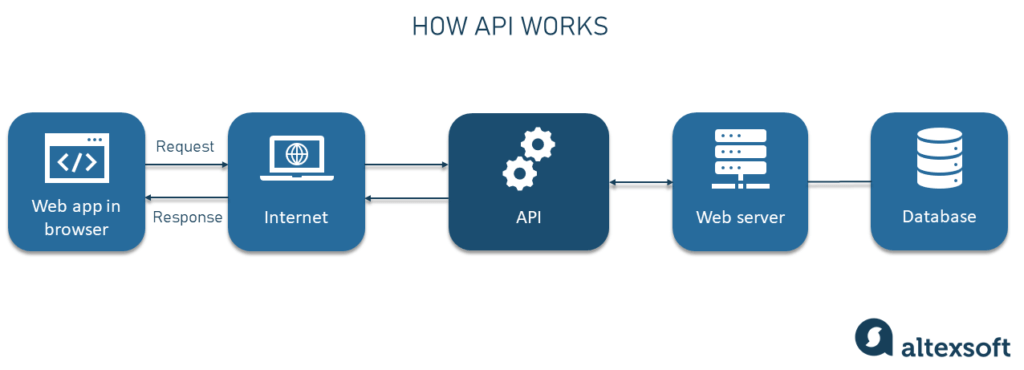

What is API An API, or Application Programming Interface, is a set of rules and protocols for building and interacting with software applications. APIs define how software components should interact, and allow for communication between different systems. This can include allowing a third-party service to access a server’s data or functionality, or allowing different parts of a single application to communicate with each other. Recharge API A recharge API allows developers to integrate recharge functionality into their applications. This can include the ability to make payments and recharge mobile phone credit, pay bills, and other similar functionality. These APIs are… Read more: What is API

What is API An API, or Application Programming Interface, is a set of rules and protocols for building and interacting with software applications. APIs define how software components should interact, and allow for communication between different systems. This can include allowing a third-party service to access a server’s data or functionality, or allowing different parts of a single application to communicate with each other. Recharge API A recharge API allows developers to integrate recharge functionality into their applications. This can include the ability to make payments and recharge mobile phone credit, pay bills, and other similar functionality. These APIs are… Read more: What is API - Recharge & Bill Payment APIFREE Recharge API Simple mobile and DTH recharge API to integrate in your website with high margin. Send your recharge requests Mobile, DTH and Electricity Bill Payment API Sign up to start mobile recharge with high commission. High speed. Low complaint. High Margin. How it works? Just few steps to start It’s easier than you think. Follow 3 simple easy steps Margin Operators Commission Airtel Digital TV DTH 4.20% Dish TV DTH 4.20% Sun Direct DTH 4.20% Tata Play DTH 4.00% Videocon d2h DTH 4.20% Airtel Mobile 3.50% BSNL Mobile 6.00% BSNL Special Mobile 6.00% VI Mobile 4.10% Jio Fiber… Read more: Recharge & Bill Payment API

- AepsAADHAAR ENABLED PAYMENT SYSTEM (AEPS) AEPS is a bank led model which allows online interoperable financial transaction at PoS (Point of Sale / Micro ATM) through the Business Correspondent (BC)/Bank Mitra of any bank using the Aadhaar authentication. How to get it: Provide KYC (Know Your Customer) information to open a new account Aadhaar Number should be linked with bank a/c Service Activation: None 1-2 minutes post Aadhaar seeding What is required for Transaction: MicroATM Remember Aadhaar Give Bank name Present self (Aadhaar holder) with Bio-metrics (Finger and/or IRIS) Assisted mode Transaction Cost: NIL to customer Merchant or BC may… Read more: Aeps

- Best PAN API Solution For Easy Banking TransactionsIf you are looking for a business in the fintech industry, you must be aware of pan api solution. And when it comes to pan you should know about the best pan service provider company which provides security and availability of all basic banking services through its API.

- White Label Portal to Help You Move Forward FasterOne of our products is the white label portal that has all the necessary licenses and regulatory certifications across India. Today’s world is a world of technology that is growing vastly and occupying its feet in each and every sector. So, why not the financial sector? Thus, E-Kendrs a financial institute brought before you a variety of financial products and services to take you to the upgrading digitally centric world.

- Looking for Best Fintech Service Provider for AePS Business ?Do you want to know the best Fintech service provider in India? This space can be crowded and technology can be misinterpreted and complicated. As there are many apps and websites pertaining to Fintech solutions. Thus, this is the right place for you.