Recharge & Bill Payment API

FREE Recharge API

Simple mobile and DTH recharge API to integrate in your website with high margin.

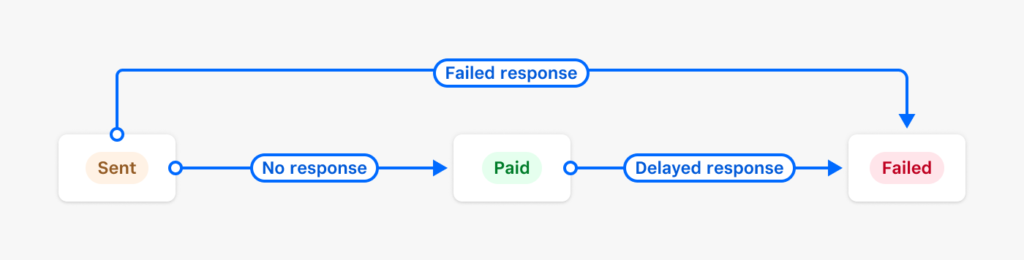

Send your recharge requests

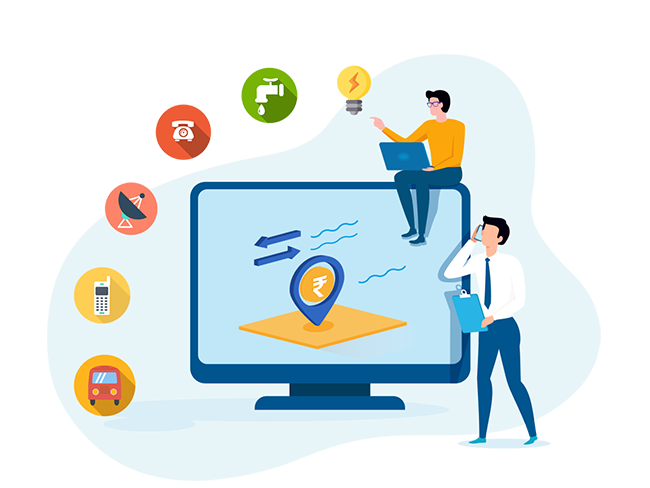

Mobile, DTH and Electricity Bill Payment API

Sign up to start mobile recharge with high commission.

Easy to integrate

Recharge APIs are easy to integrate in your website with JSON and XML Response.

High Speed Recharge

Mobile and DTH Recharge is very fast and you will get response in few seconds.

100% Secure Payment

Payment you make is 100% safe and secure, we provide GST Bills for all your payment.

24x7 Billing system

We are online 24x7 and we will update your wallet once we receive transaction details.

High speed. Low complaint. High Margin.

Prepaid Recharge

Recharge All prepaid operators like Airtel, BSNL, Vodafone, Idea and JIO.

Postpaid Recharge

Recharge All postpaid operators like Airtel, BSNL, Vodafone, Idea and JIO.

DTH Recharge

Recharge Airtel DTH, Dish TV, Sundirect, Tatasky and Videocon D2H Online.

Electricity Bill

Electricity Bill payment and Electricity Bill fetch APIs Available.

How it works?

Just few steps to start

It’s easier than you think. Follow 3 simple easy steps

Register for free

Simply sign up online for free and verify your identity

Integrate the API

Integrate the API in your website to start recharge.

Make your payment

Send us your funds with a bank transfer and we'll notify..

You're all done!

Now you can do all mobile, DTH and utility bill payment...

Margin

| Operators | Commission |

| Airtel Digital TV DTH | 4.20% |

| Dish TV DTH | 4.20% |

| Sun Direct DTH | 4.20% |

| Tata Play DTH | 4.00% |

| Videocon d2h DTH | 4.20% |

| Airtel Mobile | 3.50% |

| BSNL Mobile | 6.00% |

| BSNL Special Mobile | 6.00% |

| VI Mobile | 4.10% |

| Jio Fiber Mobile | 0.10% |

| Jio Mobile | 3.50% |

| Airtel PostPaid | 0.20% |

| BSNL PostPaid | 0.20% |

| Jio PostPaid | 0.20% |

| Vodafone Idea PostPaid | 0.20% |

| JioFiber PostPaid | 0.00% |

Bharat Bill Payment System. – BBPS

| Operators | Commission | BBPS LIVE |

| Google Play Recharge | 1.40% | BBPS |

| LIC | 0.40% | BBPS |

| LPG Booking | Rs.1.00/- | BBPS |

| Electricity Bill | Rs.1.50/- | BBPS |

| Broadband | Rs.1.50/- | BBPS |

| FASTag | 0.15% | BBPS |

| Pipe Gas | Rs.1.50/- | BBPS |

| Insurance | Rs.1.50/- | BBPS |

| Loan EMI | Rs.1.00/- | BBPS |

| Water | Rs.1.00/- | BBPS |

| Landline | Rs.1.50/- | BBPS |

| Credit Card | Rs.0.00/- | BBPS |

| Municipal Taxes | Rs.2.00/- | BBPS |

| Subscription | Rs.2.00/- | BBPS |

| Education Fees | Rs.2.00/- | BBPS |

| Housing Society | Rs.2.00/- | BBPS |