A recharge and bill payment software is a type of fintech software that allows users to make payments for various services such as mobile recharge, utility bills, DTH recharge, broadband, and more. Here are some features and benefits of recharge and bill payment software:

- Payment options: The software allows users to make payments through various options such as credit/debit cards, net banking, mobile wallets, UPI, and more.

- Multiple service providers: The software integrates with various service providers, enabling users to recharge or pay bills for multiple services in one place.

- Automated payments: The software can automate recurring payments, making it easier for users to pay bills on time.

- User-friendly interface: The software has a user-friendly interface, making it easy for users to navigate and make payments.

- Security: The software provides secure payment options, ensuring that user information and transactions are safe and protected.

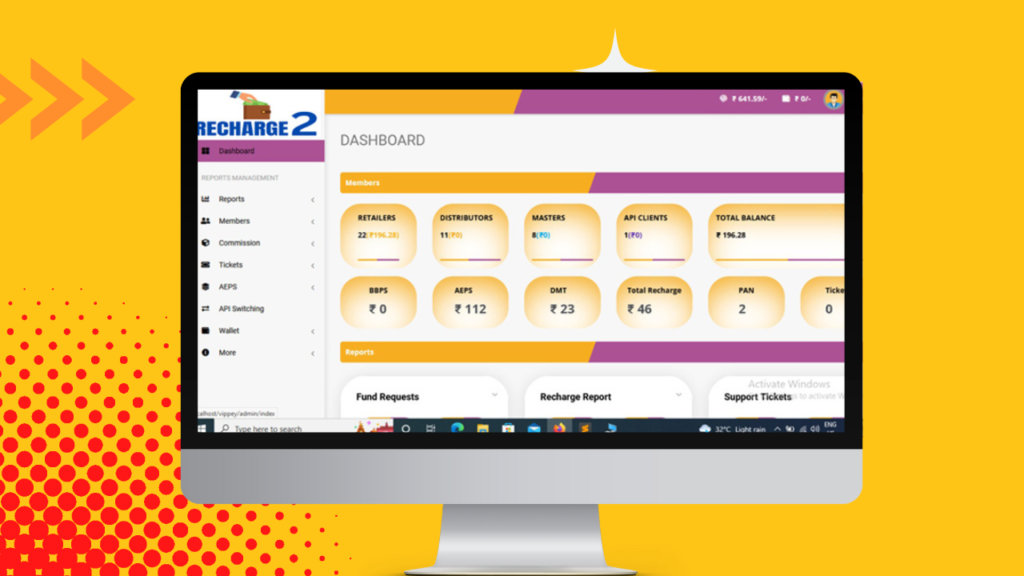

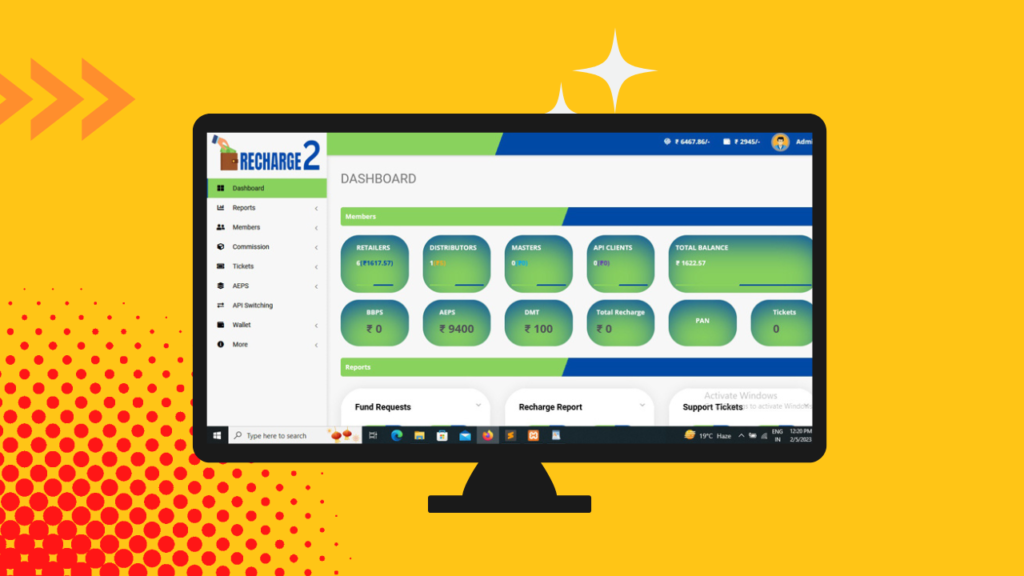

- Reports and analytics: The software generates reports and analytics, providing insights into user behavior and payment trends.

Overall, recharge and bill payment software provides a convenient and efficient way for users to pay bills and recharge services, saving time and effort.

Fintech (financial technology) services refer to innovative digital platforms and tools that provide financial services to individuals and businesses. Here are some examples of fintech services:

- Digital payments: Fintech companies provide digital payment solutions such as mobile wallets, peer-to-peer (P2P) payments, and online payment gateways.

- Personal finance management: Fintech apps and tools help users manage their finances by tracking their expenses, creating budgets, and providing investment advice.

- Online lending: Fintech companies provide alternative lending solutions to traditional banks. These platforms connect borrowers with investors, enabling them to get loans quickly and easily.

- Crowdfunding: Fintech services also enable businesses and individuals to raise funds through online crowdfunding platforms.

- Robo-advisory: Fintech companies offer automated investment advice using artificial intelligence and machine learning algorithms.

- Blockchain-based services: Fintech services leverage blockchain technology to provide secure and transparent financial transactions.

Overall, fintech services offer a range of benefits such as convenience, accessibility, and cost savings, making them an increasingly popular choice among consumers and businesses alike.