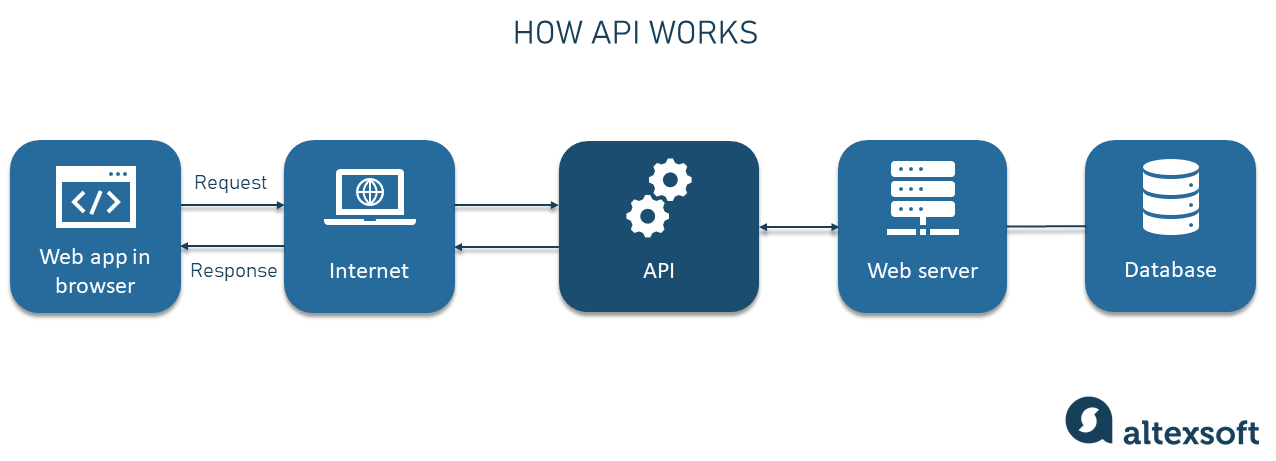

What is API

An API, or Application Programming Interface, is a set of rules and protocols for building and interacting with software applications. APIs define how software components should interact, and allow for communication between different systems. This can include allowing a third-party service to access a server’s data or functionality, or allowing different parts of a single application to communicate with each other.

Recharge API

A recharge API allows developers to integrate recharge functionality into their applications. This can include the ability to make payments and recharge mobile phone credit, pay bills, and other similar functionality. These APIs are typically provided by mobile network operators or payment service providers, and can be used to create a wide range of applications, such as mobile wallet apps, mobile commerce apps, and other similar applications. Recharge API’s are also used by Recharge portals and aggregators to facilitate and automate the recharge process for their customers.

Bill payment API

A bill payment API allows developers to integrate bill payment functionality into their applications. This can include the ability to pay bills for utilities, credit cards, loans, and other services. These APIs are typically provided by financial institutions, payment service providers, and utility companies, and can be used to create a wide range of applications, such as personal finance management apps, mobile banking apps, and other similar applications. Bill payment API’s are also used by Bill payment portals and aggregators to facilitate and automate the bill payment process for their customers.

These APIs can be used to automate the process of paying bills, allowing users to schedule payments in advance or set up recurring payments. They can also be used to retrieve information about bills, such as the due date, amount, and status of a payment. Some bill payment APIs may also provide additional functionality, such as the ability to view and download bill statements, view account history, and more.

Bill payment services

Bill payment services are a way for individuals and businesses to pay their bills online or through mobile applications. These services can be provided by financial institutions, such as banks, or by third-party companies that specialize in bill payment.

There are several types of bill payment services:

- Online bill pay: This service allows customers to pay their bills through a bank’s or a biller’s website.

- Automatic payment: With this service, the customer authorize the biller to automatically deduct the amount of the bill from their bank account each month.

- Mobile bill pay: With this service, customers can pay their bills using a mobile device and the biller’s mobile application.

- Over-the-counter bill payment: This service allows customers to pay their bills in person at a physical location, such as a bank or retail store.

Bill payment services can help customers save time and money by automating the bill payment process and eliminating the need for paper bills and mailing payments. They also provide a convenient way for customers to manage and keep track of their bills.

However, it is important to ensure that the bill payment service you use is legitimate and secure to avoid fraud.

UTI pan card API

UTI PAN card API is an Application Programming Interface provided by UTI Infrastructure Technology and Services Limited (UTIITSL) for developers to integrate PAN card (Permanent Account Number) related services into their applications. UTIITSL is an Indian government-owned company that provides technology infrastructure services for various government schemes and services, including PAN card services.

The UTI PAN card API provides several functionalities like:

- PAN card application and status tracking

- PAN card details retrieval

- PAN card correction

- PAN card generation

- PAN card reprint

This API can be used to automate the process of applying for and managing PAN cards, and can be integrated into a wide range of applications, such as e-filing portals, e-governance portals, and other similar applications.

It is important to note that in order to access the UTI PAN card API, you will need to register with UTIITSL and obtain an API key. Additionally, the API is intended for use by authorized entities only and may be subject to certain limitations and restrictions.

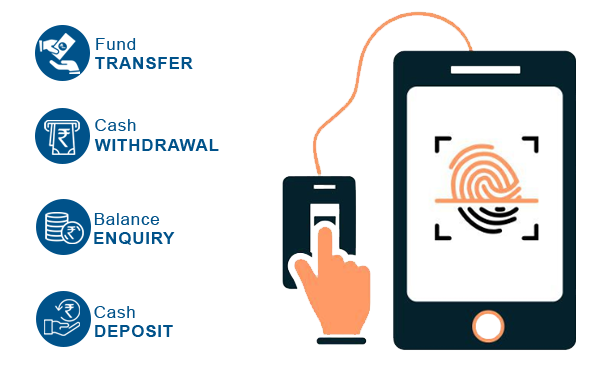

payout API

A payout API allows developers to integrate payout functionality into their applications. This can include the ability to send money to individuals or businesses, pay out commissions or rewards, and other similar functionality. These APIs are typically provided by payment service providers, financial institutions, and online marketplaces and can be used to create a wide range of applications, such as e-commerce platforms, online marketplaces, and other similar applications.

A payout API can be used to automate the process of sending money, allowing users to initiate payments in real-time, schedule payments in advance, or set up recurring payments. They can also be used to retrieve information about payments, such as the status, amount, and transaction history. Some payout APIs may also provide additional functionality, such as the ability to manage multiple recipients, support multiple currencies, and more.

It is important to ensure that the payout API you use is legitimate and secure to avoid fraud and to protect sensitive financial information. It is also important to check for compliance with regulations such as anti-money laundering (AML) and know your customer (KYC) as well as fees and limits associated with the API.